Advanta Closes One Million Credit Card Accounts

Advanta, a credit card provider for small businesses, announced today that it is shutting down all one million of its customer accounts on May 30. As a longtime customer I was told today via email that I must stop using the cards in four days. The bank has reassured me, however, that I may keep paying the bill after that date. "You may continue to pay down your account balance over time, as allowed under your Advanta Business Card Agreement," the email states. Since Advanta has been jacking up interest rates like crazy lately, as the Los Angeles Times reports, it would probably help the company if I took as long as possible to pay the remaining balance.

Advanta, a credit card provider for small businesses, announced today that it is shutting down all one million of its customer accounts on May 30. As a longtime customer I was told today via email that I must stop using the cards in four days. The bank has reassured me, however, that I may keep paying the bill after that date. "You may continue to pay down your account balance over time, as allowed under your Advanta Business Card Agreement," the email states. Since Advanta has been jacking up interest rates like crazy lately, as the Los Angeles Times reports, it would probably help the company if I took as long as possible to pay the remaining balance.

I've been relying on Advanta for day-to-day expenditures while running World Readable, my network of web sites. I fortunately have a second credit card, which I set up a while back when poppa needed two high-definition TVs. I should be able to switch all of my recurring charges for the business to that account.

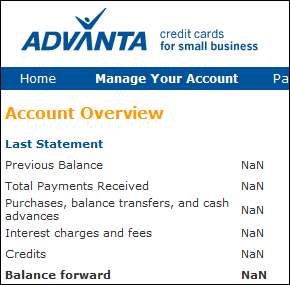

Because Advanta provided almost no notice, I've been scrambling today to download all of my transactions and billing statements, which I need for tax purposes. Because there are one million people with a compelling reason to be using its web site today, Advanta.Com has been crashing worse than our country's financial system. At the moment, the site says that I owe a balance of "NaN" dollars in my account. NaN is a constant value that means "not a number" in several programming languages, including PHP, JavaScript and Visual Basic. It could be worse -- there's also a constant called Infinity.

The weblog Consumerist broke this story eight days ago and provides a followup explaining why the company is in such big trouble:

Advanta's customers defaulted last month at a rate of 20.15 percent, compared with 17.31 percent in March, the company said Monday in a regulatory filing related to the Advanta Business Card Master Trust, which bundles Advanta's small-business loans for sale to investors.

Outstanding credit-card balances at the end of April were $4.5 billion.

I know one of the disgruntled Advanta customers quoted by the LA Times:

Television writer and producer Bill Taub, president of Jabberwock Corp. of Los Angeles, didn't notice for four months that the interest rate on his Advanta small-business credit card had jumped to 19.99% from 7.99%. A call to customer service got it dropped to 10.99%, but he said his request for a refund was refused.

"That was outrageous," said Taub, whose TV credits include episodes of Hollywood Babylon and Relic Hunter. He hadn't yet heard that Pennsylvania-based Advanta Corp., which has been hit with rising losses in its portfolio, won't allow any of its small-business customers to put new charges on their cards after June 10.

Taub and I worked briefly together in 1994 for Zing Systems, an interactive TV venture based in Denver that went bankrupt years before banks and insurance companies made it cool.

Comments

I have been a loyal and reliable card holder for over 10 years. I paid way over the minimum to have my limit grow to $29,000.. paying $500 per month until it was paid off in full. Now they close my account! I have a small business and will be devistated. Why do the hard working, honest paying people get hurt?

Advanta won't answer their phones, but it is probably because the other 1 million accounts they closed today are trying to get through. Does the government or Advanta think this will help the economy in any way, or hurt the situation even worse?

Thank you for this article. I have had many clients of mine who had business credit cards with Advanta, and also received the same e-mail that their credit card will be closed by May 30th.

I work for PNC Bank, Hockessin Delaware, and I will gladly be helping my clients who had their credit card cancelled apply for our PNC Business Credit Card.

We have a Business Mastercard with Reward Points. The card pays 1% cash back for total dollar total at the end of each monthly statement.

Thank you

Lori E Heckle

PNC Bank, DE

302-235-4001

I was one person that did get through the phone lines. I don't have a high credit limit. But, I did received a letter in late April telling me I had until May 18th to freeze my account at the 8.7 percent interest rate or it would be raised to 17 percent. I chose to keep it open just in case I needed it for an emergency but planned to pay the balance down.

...Then, one week after the deadline passed, they close the card. Now, I still don't have a card. And, according to the supervisor, am now obligated to pay the doubled interest rate because I missed the deadline. That's bull pucky!!!

Advanta knew that this was going to happen but didn't warn it's customers.

I encourage Advanta business card customers to contact their U.S. Senators and Representatives to complain. Also, the address to complain to Advanta is:

Advanta Small Business Card

P.O. Box 30715

Salt Lake City, UT 84103

Advanta in financial trouble?

Good, I hope very exec at the place goes to jail and becomes a shaw shank maid.

This loan shark company jacked my rate up to 38%.

I hope the company dies a slow and painful death, can not happen fast enough!

More of the same from investor groups that have become addicted to unreasonable rates of return over the last 10 years. Woo-hoo! It's a party all the time for the short-term investor looking to get maximum value for parking their butt in front of a computer and running some ridiculous investing program guaranteed to get you rich for almost no effort!

We, the small businesses and our employees (whom we can no longer afford to employ) are building things, coming up with ideas, inventing and helping to create jobs and move money in this economy, and we are left out at all levels. Big mistake, which will be felt soon enough once the rarified air of Wall Street clears. Good luck, short sellers, and remember that when the people running the pump and dump decide to scuttle the ship, most of you won't make it out in time.

I am still in a state of disbelief. I own two small businesses and have 3 associates who travel every week. I like many others, depend on my credit card. I work in the fraud industry. My business has grown almost 40 percent in 2009. Now it looks like I am going to have cut back because I won't be able to find a business credit card for my staff in 5 days.

What is also troubling aside from the fact that they gave us all a 5 day notice, they are not offering to help us find alternative solutions. I agree those that have been affected by this must write their Senators and Congressmen.

This does present an opportune time for a first class bank, if there are any left, to step up to the plate and help the small business community. The "goodwill" they show will be benefit them enormously.

Advanta Bank, just another casualty of Barrack Hussein Obama, Nancy Pelosi, and Barney Frank. It's going to get a whole lot worse before it gets better.

Oh, for those of you who want to point back at the past administration for "BLAME", keep pointing because then President Bill Clinton, and Barney Frank instigated the entire Fanny Mae & Freddy Mac fiasco by forcing lenders to provide loans to individuals who were incapable of repaying them. This took EVERYONE DOWN - and you know it. But don't take my word, look it up for yourself.

Now we have Obama who wants everyone to pay for it, while bailing out individuals from the housing crisis. SOCIALISM, America voted for it, it's COMING and COMING STRONG. Just read about what Obama wants to do for California! He wants to take their debt and make it a federal debt. This is taxation without representation he should be tossed in jail.

Advanta and other credit card companies don't owe any of you people anything. They're usurers - everyone knew that going in. They loaned you money and charged you the highest rates allowed by the government - the people YOU elected.

What's everyone so angry about? Did you guys really expect them to charge LESS than they're legally allowed to? Did you expect them to loan you money out of sheer goodwill?

And as for the dolt about (#7 Visitor) - Advanta isn't a mortgage lender. It's a credit card company, and it's currently in the process of shedding all its customers because so many of them are defaulting, not because of anything this new President (in office a few months) or the Speaker of the House or eve Barney Frank did. That's demonstrably untrue.

Making those kind of comically false statements only serves to make the GOP seem hopelessly out of touch.

What hope does the Republican party have when their advocates say things like "America voted for it" and "This is taxation without representation" in the same paragraph.

Sad.

#8- Are you kidding? What am I so angry about? I have a bunch of employees with credit cards they use every day. I just got a letter TODAY telling me in 3 days it will be canceled. Any suggestions for getting a half dozen credit cards and a huge limit account on my desk in 3 days? This is a very irresponsible, customer harming way to do business. I hope Advanta is now out of business for good. If I ever find any business or venture they are a part of I will not only avoid it, I will tell everyone I know to avoid it. The main fault for causing me so much inconvenience lays on Advanta. The rest lies with Barney Frank, and the other idiots who keep trying to legislate giving irresponsible poor people the same credit as me. It also falls on Obama because he is sending the message that credit card companies are going to be harassed big time to make him look like a hero to the poor irresponsible people again. One more thing. Obama is for taxation without representation. That is what taking from the few rich and giving to the many poor who outnumber them is. And America was lied to and tricked, but they did vote for exactly that. When they find out that the top 10% of income makers can not actually afford all of Obama's programs and the country tanks because of it, they will regret that vote. He makes Jimmy Carter look smart, and that is hard to do. Every time we bail out another company or state we reward bad behavior and punish good behavior. Let people, businesses, cities and states tank and start over instead of dragging the whole damn country down with them. Good riddance Advanta.

So, you have THREE more days to milk this card before Dennis Alter can rip you off with higher interest rate.

This is the worst credit card ever.

Will they file for BK before GM?

I hope so!

Response to # 7 visitor

I am surprised you still live in California!

Democratic Socialist Party members are already spread all over 50 states.

You need to find RNC (Rush, Newt, Cheney) country soon.

Count me into the list of suckers... I got the letter today. What do you all think about the best alternative? Where should I be applying for a new credit card? Recommendations wanted, and yes, ADVANTA SUCKS!

It is ludicrous that 'any' corporation should only give 4 days notice of closing its doors.

And the kicker for me, was their email. It was signed "John F. Moore President, Adavta Bank Corp. (Notice the spelling of "Advanta").

Advanta is an evil company and what goes around comes around. I hope they're gone forever. They deserve extinction.

My interest rate was raised, over time, from about 9% to a final, UNBELIEVABLE, USURIOUS rate of 37%!!! I was NEVER late on a payment and there was never a rational explanation for the extreme hikes. Toward the end I was making about $600 payments and almost $500 was going toward interest!!!

Their defaults went up to 20%??? Well, DUH! If you were paying $500 toward interest and only $100 toward principal, wouldn't you default? I considered it...

But instead, I got out several months ago instead of defaulting, I took out a loan from a reputable company and paid Advanta off. Then I cut my Advanta credit card into tiny, tiny pieces and threw them into the wind. It was a great celebration!

Advanta created its own nightmare and, please, may it haunt them out of existence totally and completely.

So much for the concept that business will regulate itself without government "interference." Without regulation, they're buzzards and will pick every last piece of flesh that that they can.

It's called "greed."

"Advanta is an evil company and what goes around comes around. I hope they're gone forever."

Are you people children? A company isn't evil. A company can't be evil. A company is not human.

Advanta won't be "haunted" like one of you bizarrely prays for. Advanta is not a sentient being. Advanta doesn't have feelings or emotions. It is a company.

Advanta may go out of business, but the humans that ran it don't really care. They will go on to run other companies. Probably credit card companies. And you'll sign up for THOSE credit cards too and then complain when THOSE "evil" credit card companies screw you.

But you'll never even know that it's run by the same humans who are screwing you over now.

Except they DIDN'T screw you over. Everything they did was spelled out in your credit card agreement - that zillion-page document they sent you when you signed up for the card. The one you didn't read because it was too many pages and you didn't feel like reading it.

It's your own fault.

Barney Frank doesn't have anything to do with Advanta and neither does the President. Advanta didn't give any campaign contributions to either politician. Advanta DID contribute cash to SPENCER BACHUS, ROBERT BENNETT, ERIC CANTOR, MICHAEL CASTLE (three times), JASON CHAFFETZ, TOM FEENEY (three times), SCOTT GARRETT (twice), MICHAEL JOHANNS, WALTER JONES, PETER KING, RANDY NEUGEBAUER, ED ROYCE, JEFF SESSIONS and PETE SESSIONS.

All Republicans.

Advanta also gave campaign contributions to the top ranking Republican in the Senate MITCH MCCONNELL, and they gave the most money of all to Republican candidate for President, MITT ROMNEY.

They wrote the laws that allowed Advanta to ream you.

If you're a Republican pissed off about Advanta, now you know who to blame.

Check your statements, I came across a bogus charge 35.00 for a returned check fee

Made an inquiry, the Indian fellow explained it was a returned check fee against one of the cc checks they so frequently send

I explained that

1. There should be no fee as my card limit was not breached

2. the check was drawn against Advanta, as he repeatedly tried to explain that there were insufficient funds in the drawn checks account,

and I repeatedly made him aware that ADVANTA IS THE BANK the check is drawn

that was 3 days ago, knew I smelled a rat

Lord, I just watched Idiocracy the other day and it looks as though 2005 is already here! Barney Frank caused it. Nancy Pelosi caused it, W caused it, who cares, really? WE caused it by signing up for cards with open-ended, one-sided agreements favoring the issuers, and also because we have begun using them for everything.

More scary than Advanta being irresponsible is that when one million small business owners lose their access to ready credit, the Stock Market not only doesn't notice, it GOES UP almost 200 points because investors think we're doing great now! Yeee-Haah!

I don't fault Advanta for jacking up interest rates, because that's what all credit card providers will do these days if you give them an opportunity.

I do fault them for running their business so badly that they've thrown out several hundred thousand good customers like me along with all the bad ones. They didn't even find a way to fail gracefully and sell their good assets to another company. Four days notice is ridiculous. I've been an Advanta customer for more than six years. I don't think I've been late on a payment more than two or three times, never by more than a few days.

How can a credit card company take so much risk that a total shutdown was the solution to its problems? I'd love to know how the management of the company managed that feat.

Higher defaults rates I expect in my opinion may have been directly related to unreasonable and unfair rates they imposed upon even their most responsible customers. Maybe they were the cause of their own demise by imposing such unrealistic rates upon their customers they had no choice to default. It's one thing to make money, but then there is pure greed and insanity.

Who could pay an interest rate over 30%? Not me! My husband was never late on a payment, never exceeded his credit limit and always paid well over the minimum and his interest rate went from single digits to over 30% within several months time. Stated reasons were "proprietary" when we called. Couldn't even get a straight answer. Wrote to the subcommittee of investigations in Washington on this and Senator Obama at the time. Still have his letter. 16 pages worth of info. Yes, it's time we all come together and get Washington to represent the people, not the big banks and lobbyists. Write to your representatives and senators. Also, I was told the credit card industry spends hundreds of thousands of dollars to protect their interest in Washington. Time for us to do some the same and be heard. Write, complain, stomp your feet and just be heard!!! Being passive will only allow this abuse of the american people to continue!

Just to set the record straight, my husband never defaulted. I paid off his credit card with mine to avoid the insane rate. I have no problems being responsible and paying my bills but when companies try to unfairly take advantage of people that are paying their dues, well then something is just not right here. Hope they do pass some laws to protect us. It's long over due.

I have just received my notice of cancellation at PowerTech Electric.

I have use Advanta for years and always paid the balance in full every month. So here we go again..........The people who use credit with responsibility get screwed. This will cause many headaches for me trying to conduct business. My employees use credit cards on a daily basis. What a joke!

Todd Johnson

I find it unbelievable that a card compnay gives 3 days notice

of termination.

As many of you have said, we were a loyal corporate customer, paid bills always on time usually in full each month. BUT they did increase the interest rate from 8.99 to 31.9 over night.

I wish only evil for these corporate scammers, and all of us/you should default on repayment and then these rich corporate officers would get nothing.

Two meanings of "evil" are: 1) "harmful; injurious" and 2) "anything that causes harm, pain, etc." Clearly, these definitions both describe Advanta, the company. And equally clearly, neither definition requires that what it is describing be human.

Advanta is...well, WAS...evil and greedy. And yes, those are the two attributes that caused its crash.

And no, it was NOT the fault of the credit card holders who didn't want to read, or wasn't able to read, the zillion pages of explanation (and absolutely should not have to!). It was the fault of a government who no longer believed in regulating companies which could (and would, and did!) easily slide into greedy evilness without regulation.

Credit card holders should have rights also; all rights should not be in the hands of the companies. And the credit card holders' rights and terms of agreement should be clearly spelled out, large enough to read, and in language easily understood by any average person, not just lawyers. They should NOT be couched in zillions (or even 15 or 20) pages of tiny print that require a magnifying glass and that, even then, are incomprehensible to an average person.

These changes are in progress and it's about time! Meanwhile, Advanta has gotten exactly what it deserves: extinction. Good riddance.

VJP, your Webster's Dictionary definition of "evil" proves my point. What "harmful" thing did Advanta do? Raise your rates? Nope, a company can't do that. A HUMAN at a company made that decision. Which was all spelled out in your contract.

Oh wait, you claim "it was NOT the fault of the credit card holders who didn't want to read, or wasn't able to read, the zillion pages of explanation (and absolutely should not have to!)"

You're right, VJP - when you enter into a loan agreement with a banking company, you absolutely should NOT have to read the terms of your agreement.

The NERVE of Advanta for asking to read and approve the terms of your contract!

The NERVE of Advanta for asking you to read and approve the terms of your contract!

Advanta dumped me too. Not a problem though. I will use my personal Capital One credit card for my business expenses now. And I will wait until the dust settles to see if a new, small business credit card will emerge from all this. My business is in a position to easily wait/shop for this new credit card service one, two, perhaps five years if necessary.

Just read today where President Obama signed a law giving credit card consumers more rights/protection. YEAH!!! Thank you President Obama! He has done more for us in this regard than any other President I know of. Do you know of any others? It would be interesting to see how many Presidents had contributions to their polital campaign from credit card companies. Can we get that info?

Just want to stick my neck out a little bit, I read my credit card agreement front to back. I just don't sign something without reading it. Who would ever think that a credit card company would raise your rates to over 30% if you paid all your bills on time and were never late with a payment. Again, while rates would be expected to fluctuate some with the prime lending, a rate change into the triple digits from single digits in a few months, is just plum nuts.

When I called the company on this they said, "read your contract, in fine print it says we can raise your rates at any time for any reason." When I replied about paying our bills on time and the effect it would have on us, they appeared not to care in my opnion. I told them they were destroying peoples lives here, no change in their response. So yes I can see how people would view that credit card companies are evil. The policies were written by people who in my opinion didn't care about their responsible customers or the effect it would have on their lives by raising their rates just because they could. It's about time that we have a law to make the credit cards accountable not just to legal standards, but to fair and reasonable standards.

In addition, the methods that Advanta used to inform their customers of their rate increases were quite tricky in my opinion. It is in my opinion that they really don't want it to be obvious to the consumers. For example:

On the back of one communication, in very, very small print, there it was, an interest rate over 30%. On the front they were advertsing some type of shipping service or such. I read everything. Hidden on the back with all the other blah, blah, blah in very, very small print was the rate increase!

Very tricky and sneaky in my opninion. Anyway, 16 pages of info to Washington on this. Also, found out that they don't have to confirm you rec'd the notice. Their legal obligation ends at the drop box on their end according to a supervisor at Advanta. What if the mail was lost? This is in regard to the opt-out notice. That was an isssue for me. They don't have to confirm receipt of the notice. Sorry for the length of this paragraph. Still venting till this day about my terrible experience with this company.

I just received notice of my account closing(May 28). And this is only because I went online to my account. I never received notice in the mail. As a small business-we have one card-now I'm scrambling to get another card. In the meantime-we need to take out cash for all purchases. I've paid my balance in full every month. Being able to continue to pay off my balance is of no concern. But I do want to know if I'll get the "cash back" check for the current purchases. Probably not!

Advanta knew they were going to do this weeks or even months ago. They didn't just decide it over coffee one day this week. Shame on them. Small business owners are the backbone of this country. They have swept the rug out from many of them. I am a small business owner, in business for nine years. This will give me headaches till I get knew cards for my employees,but we will survive. And if you don't think this has anything to do with our current administration, PLEASE take your head out of the sand. I don't hear any plans on saving or protecting the small business owners of this country. The small business owners are in my prayers.

Advanta has been egaged in Economic Terrorism.

Advanta is the guilty party in this scenario. This started quite some time ago. Advanta has been engaged in un-ethical practices which have brought us to where Advanta is right now.

Advanta failed to send many people notices in 2008 that their interests rates would be going to reach the mid 30-40% range.

Advanta failed this customer by refusing to lower the interests rate attached to the card, despite an excellent "clear" payment history. EXCUSE: "because we can, due to the current economic climate".

Advanta could potentially strand people that are traveling and unaware of the recent emails. WHICH fail any other test of legal notification. By their own admission, they didn't send out a physical notice with proper time for people to make other arrangements.

Advanta has created an environment that compelled 20.15% to default. Then, Advanta plays the victim card saying they have to punish good customers with higher interest rates because they can...??? Just how ignorant does one have to be to not connect the dots. Make a debt near to impossible to repay and the customer most likely cannot repay.

Advanta made poor business choices and should be held accountable.

Wouldn't it be poetic if all Advanta card holders refused to pay their remaining balances. It would send a BOLD message to all credit companies that Americans are sick and tired of bailing out crooks that engage in predatory lending practices to Terrorize Amercians.

Advanta is well aware of the current economic environment and intentionally stepped up predatory tactics to "unjustly profit" off the backs of decent hard working Americans.

Advanta is nothing more than Economic Terrorists. Which causes me the most concern. Because this nation has come to rely on economic terrorists.

I found this thread because one of my clients contacted me, told me the short story, and asked me to change the card I had on file for her account.

But I do understand and I do feel your pain.

Years ago I had a business card (the company shall remain nameless but probably shouldn't) with a company that raised my rate to an unconscionable amount for what I considered an unconscionable reason.

I'm writing here to let you know that you don't have to pay the unconscionable rate but you do have to suffer the consequences.

In my case, I simply stopped paying. They started calling me.

I offered to immediately pay the past due balance and make future payments on time; all I asked of them was that they move the rate back to what it was previously. They agreed. They actually agreed. Then I asked them to send me the agreement in writing.

They refused! It was against their policy.

Think about it: it's against their policy to put an offer in writing. You don't think they'll honor it do you? After all, it's your word against theirs.

I asked them to stop calling. They didn't. I changed my phone number. Yes, it was inconvenient, but I felt strongly. I didn't publish our new number in the phone book or the directory listings (it costs a few cents a month, depending on your phone company). We continued to advertise on the 'net and to make sure our new number could be easily found on the 'net. That works because almost no-one uses information or the phone book anymore.

But the (stupid?) people at the CC company never looked on the 'net, and never found the new number. They never called again.

Did it hurt our credit? Yes. For a few years we had trouble getting new credit but every time we found a negative on our credit reports, we wrote the full version of our story. We switched to a cash business model. That impacted our growth for years, but we made it through.

The CC company never sued us, though over the years they sent us postal mail offers for us to settle our account. Even after the statute of limitations had past, they kept sending offers. We threw them away.

This is important: Every time you make a payment or agree to make a payment, the statute of limitations gets extended. Don't EVER do it. The only time to pay them if if/when you decide to pay in full.

Note they never risked taking me to court.

I'm a libertarian, and I don't need the government to protect me.

I have read this string of comments. There are a few who have decided to use political complaints and some who are posting things that are not too bright. It also appears that they are not a business owner or just are so blinded by the current histeria that they cannot formulate a rational comment to post here.

The BOTTOM LINE is that Advanta decided many months ago that they were going to use predetory tactics to enslave and squeeze as much money from the small business that they had. The news is that over 1 million small business have been stuck by Advanta to search for replacement lines of credit with as little as 3 days notice. I for one did not get ANY NOTICE. I am sure that was the same situation for many more owners. They did everything to make as much as they could before closing all the accounts. It is as bad as Bernie Madoff and you will not see anything printed in the media about this. They are only concerned with printing stories that present the current administration in good light.

The fact that there was a new law protecting consumers from some of the things that Advanta did to us small business owners, you can bet your bottom dollar those in Washington who knew this was happening, did nothing, absolutely nothing to protect the small business owner. They knew Advanta was doing this. They decided to avoid another black eye and another financial scandal and ignore this. They just went ahead and passed this law touting what a great law it was and the media just hyped it and went along with the status quo. Its great for consumers, but what about all those that were criminally raped by Advanta? Nothing....

I dont care about the BS "read the fine print" and all that other crap written about here. I dont think that anyone has to try to take the defence of Advanta in this case. Advanta did these things under the cover that "they can do anything they wanted for any reason" and made it a criminal act. Even though they probably will not be prosecuted, and it was "in the small print" they went and "created" situations to justify raising the rates, cutting the line of credit, and sometimes doing both which put a small businessperson over the limit and then they were kicked up to absurdly high interest rates. In some states they went way over the usary limits and they did not care.

I was one of the many, many business owners that used that card responsibly. I paid more than required and usually reached zero balances on a regular basis. They raised my interest rate 20 points. When I called I too got an offshore person who could not speak english well, but they were able to tell me that Advanta reviewed my account and that in this economic climate deemed me a risk! I couldnt believe it, and that person repeated that statement when I repeated that I was never late and paid always ontime. Then I asked to be connected to someone in Advanta's main headquarters. I was told that NOBODY there speaks to credit card holders. I tried to get to someone in Philly, and I was actually told that when I called. I was told there is an "800" number to call.

So instead of some people posting that "we" the SMALL BUSINESS CREDIT CARD HOLDERS, should have read the fine print and other nonsense, why not find another place to post, or start your own blog so you can write this crap there, and then you can feel good by reading what you wrote there because I am sure that there are thousands of small business owners out there right now that have been used and screwed by Advanta, that dont find what you have posted here to be very funny.

Its not the truth that we small business owners deserve what happened here.......we ARE the backbone of America! We are what makes this nation thrive economically, and when institutions like Advanta do things to us like this, it IS an attack on small business and the American economy as well.

There will not be an economic stimulus package drawn up to help the millions of small business in the United States that can use some help too. When I say this, I mean those who have been hosed by institutions like Advanta of which the family behind it has its hands in every polital pocket it could find on BOTH SIDES of the aisle. Its those people in Washington that took the handouts and money from Advanta, who knew that this was happening, that turned a blind eye to this that should also be prosecuted and made to answer for this.

So you see what happened here affected not more than 1 million small businesses, BUT MILLIONS OF PEOPLE.....this is a major story that was covered up and continues to be relegated to just certain internet sites. Where is the outrage that every newspaper and media giant shouted when the Bernie Madoff story exploded on the scene?? This is just as big for it continues to affect Millions of people..and the backbone of America's economy, the Small Business!

The interest charged is a direct response to an amateur thought-process from President Obama and his "yes" partners. Providing a grace period before a new hammer falls on credit card banks means they have to immediately increase revenue without regard to good-will with clients.

I agree with post #7 (and post #8 is clearly not a business owner or a serious student of contemporary history or politics) in that government effort to correct social injustices (as they see them) is the primary etiology for nearly all of our currect financial woes. I further believe the Obama administration is the least likely to realize this since they are blinded by power and special interest voting blocks. Clearly 1st generation immigrants have known working hard yields a better life; they have been very successful when they work hard and integrate into communities. If others in our great nation choose not to work hard, it is not right for the self made successes to fund the lazy. Not to say all social programs are not warranted or even desireable. However the balance is shifting far too greatly toward socialism and the young in this country have no perception of history or economics. We have the amateurs at the wheel while the professionals are forced to man the oars in a hurricaine. Even if the experienced pros care immensely, they are not allowed to contribute where they can most help.

Businesses carry long term loans at fixed rates (or worse, sometimes floating). Because a small business owner ownes the business, these loans are paid post-tax. Raising taxes 1% on a small business owner's personal income tax is actually around a 4% increase in his/her net income after taxes (3/4 of their income may be used to pay loans over 20 years). No one is willing to lower business loan payments so we will have a disproportionate inflation to cover expenses already set up. If 3/4 of a business owner's income goes to business loans, than 1/4 is going toward home loans and living expenses including college savings and such for kids. Since the IRS only sees income prior to business loan debt, these owners will get no special help for college, etc. This is why businesses use credit along the way during slower times, not to mention keeping up with technology and evolving standards. This is why the Advanta model is so dangerious, and it was predictable as are many problems coming down the pipe. You the consumer will pay me the dentist much more so that I can pay the IRS more while still keeping my business. If you do not pay more, there will be fewer dentists and you will get poorer service. Eventually you will pay even more and receive even less. When the problems outweigh the $250K in extra education and the $750K to set up a new office (assuming the future banks will extend the loan), you will see a drop in dental school admittance and so forth. Think I'm off base? Ask your dentist next time you see him/her.

Right - it's the etiology of dentistry. Everyone knows that.

I asked my dentist, and he got a weird look on his face and cut my appointment short. The next day I went back and his office was vacant!

Remember the days when the Mafia use to lend out money for a "huge" interest rate of 20%?!

I think they went to work for Advanta!!!!!

Not only are they charging 35% interest. They are outsourcing their customer service. Who basically just answer phones and tell you that their hands are tied? Why even wast money on any service at all? At least they could pay American's with what is left! I would feel a whole lot better knowing the money they make off the interest I am paying was staying in the US.

Imagine an America with honesty, quality, innovative, and customer friendly small business where people took pride in their work. The manufacturing, sales, design, marketing, customer service, human resources, all located in the US. Healthy 401K's, good health insurance, reasonable working hours so you could have a little time to spend with your family at the end of the day and on the weekends. A couple weeks vacation to help you rest your brain and body and come back to work rejuvenated and fresh. Everything we purchase made in the US in Small Town America! You could pick up the phone and talk to a person. That person would be able to relate to you and work with you instead of exploiting you for all you worth. Treat you line a human rather than a customer or just another dollar. Everything was fair for everyone.

Who was responsible for outsourcing everything and letting these big companies buy up every tiny bit of their competition? Everything from the food we eat to the books we read are controlled by big business. Do they really care about people or profit? Can you have a balance? Who needs more money than they could possibly spend in three lifetimes? How could you spend more on material items than some people make in a lifetime? Who does not want to help out a fellow American in distress? Who could sit by and watch people suffer because they can not afford medication or medical treatment? How can we pay an athlete $300 million, but we can figure out an affordable health care system? Who does not believe we are all created equal? Who does not want equal educational opportunities for all Americans? What have we become?

Why do you think paying some one to barrow money is good business sense?

Save some profits, use a debit card and get paid instead.

Carrying debit is stupid and this recession is why.

I definately had this card and it was the bloodlike of our small business. Its a shame to see that these companies which should be assisted unlike GM and Fannie Mac, are not getting the help from this President that is taking this country to bankruptcy and not helping the little guys.

so Advanta is not lending because their default rate is over 20%-DUH, they JACKED UP rates from single digits to 25-35 and even more -who wants to get screwed by that? It is strictly cause and effect, they started on a policy of gouging clients, clients could not afford the sky-high rates, defaulted-Dennis Alter is still living it up, though, and paying himself well, I can assure you-meanwhile, their stock is now hovering around .44 cents a share...their demise is well deserved, when I realized last September they jacked my up from 7.99 to 25%, I payed them off THAT DAY-and they forever earned my hatred. FU Dennis.

We too had our rate increased to 24.99%/35.99% with no notice and then got the cancelation notice. We had decided to try and find a way to pay it off and get out of it because it's a rip-off. When we called for an explanation they told us we were not using the card the way they thought we should. I asked what that meant and they could not give me an explanation. "Good bye--Good riddins" and welcome to what I beleive is just the beginning of such tactics from credit card companies.

My secretary stole convenience checks and deposited them in our bank only to withdraw the money as soon as the checks cleared, we were never called from Advanta or our Bank Hunington that forged signatures were being used on our two accounts with Advanta. The secretary plead guilty to the fraud and forgery of these checks and is to appear in court for her sentence on July 29, 2009 as her lawyer didn't appear at the July 15,2009 date that was previously scheduled. Advanta charges us 34% for this fraud of nearly 40,000.00

I made a deal with advanta to pay off my balance at a set amount for a set number of months. The account vice president that set this up for me made no reference that they were going out of business. This deal was made just a few days before the closing email was sent out. If you were me, would you pay these payments. How do i know that I am even really getting credit for these payments?

Help:

Simple question...should I ro should I not cash the check Advanta sent me? or wait and see if more refund money is to come?

I would suggest you call the FDIC and complain. Do not cash any checks since they say in the fine print that no other legal claim can be made. Stop paying them. Keep checking credit bureau to make sure that when they report you add dispute and note in the record that they closed all accounts prior to deliquency. Numerous fines by the FDIC for illegal rate increase with no prior notice. Keep an eye out for class action suits which are appearing in many states. Do no business with them via phone since they do not hold their end of the bargain. What they basically did is credit check accounts and anyone with A paper hiked interest rate. At one point I think mine was at 39%. I also paid many months at this crazy interest rate before realizing the situation. I also have sent a letter to Experian Supervisor to check about the many disgruntled clients of Advanta due to their illegal practices and that they might want to consider not ruining their good name for a company that is using them to shake down people who pay on time.

If you have 5k or more in balance towards advanta email me asap. I may be able to structure you for a settlement of approximately 55 cents on the dollar. debtrelief@rocketmail.com

Cash the check before it is no good! Their parent company is in bankruptcy proceedings, and Advanta Bank Corp. can't last too much longer before the FDIC shuts them down!

www.advantareorg.com

I am a non-profit organization and was very angry that Advanta would do this to small business owners who are trying to help others. The interest rate is so high it is extremely difficult to pay it, we do not get much money in, I have always made my payments and have made them consistently on time, what am I to do.

Disgusted!!!

advanta credit card is the biggest scam around. What ever you do don't pay any of your payments as the company is going out of business and Will tell you any way they didn't receive your payment on time so they can hike your rate up to the max 34.9 percent as they did mine. They are trying to collect as much money as they can before they sell out there evil disgusting mafia owned company stay away from any advanta credit card or you'll be sorry so sorry!!!!!as I was as we all are check out some of the other mishaps. mary from other people that have also been scammed by advanta credit card company./ stay away if it's not to late>> I'm up shit creek without a paddle. Thanks to advanta

Man I have good credit and it a shame I can't keep paying these higher than normal interestrate so much so I'm considering dafaulting due to the interest rate over 30% but it will look as if I'm the illresponsible consumer when in fact it the company who is doing the screwing.

I got screwed by them too. 60K @ 0% for 18 monthes I paid 4% for that then they call the loan and jack the rate to 29.99%

Hello chapter 7 BK Go F yourself ... In the end I got away with over 300k ...sucks but they deserved it.

Got 4 new cards in 6 months .... back to business and life is good

About a year ago I was late on a payment. At that time Advanta increased my interest rate to a rediculas 32.99%. I called and spoke to someone at their headquarters who informed me after a number of on time payments my interest rate would be lowered to a reasonable rate.

Now Advanta NO customer service is telling me they are not lowering any interest rates. So I was lied to.

Add a Comment

All comments are moderated before publication. These HTML tags are permitted: <p>, <b>, <i>, <a>, and <blockquote>. This site is protected by reCAPTCHA (for which the Google Privacy Policy and Terms of Service apply).